Part I: Summary

Publicly available documents (as described and linked to in Part II) demonstrate the following:

1. Over the last several years, President Trump’s former campaign manager Paul Manafort has participated in a series of mortgage loan transactions whereby Manafort (or an affiliated limited liability company) borrows large amounts against real estate that was originally purchased without financing. The aggregate amount of the borrowing seems to be increasing over time. The earlier mortgages are with large commercial banks and the later mortgages are with smaller lenders.

2. The mortgages are home equity loans and construction loans secured by properties that appear to have been bought and paid for in cash by holding companies associated with Paul Manafort and his son-in-law, Jeffrey Yohai. In some cases we can see that the loans are personally secured by Manafort and Yohai.

3. An entity connected to Manafort and Yohai defaulted on two short term loans with relatively high interest rates (9.99%). The loans were personally secured by Manafort and Yohai. The loan was made in March 2016 and by June 2016, three months later, the lender, Genesis Capital, commenced foreclosure proceedings on the associated property, a townhouse at 377 Union Street in the Carroll Gardens neighborhood of Brooklyn.

4. On November 17, 2016, a complaint was filed in federal court against Yohai by an investor in one of his real estate companies alleging that Yohai is operating a Ponzi scheme in connection with his real estate business. The defense attorney, representing Yohai, is listed as Bruce E. Baldinger — the same attorney used in connection with many of Manafort’s real estate transactions.

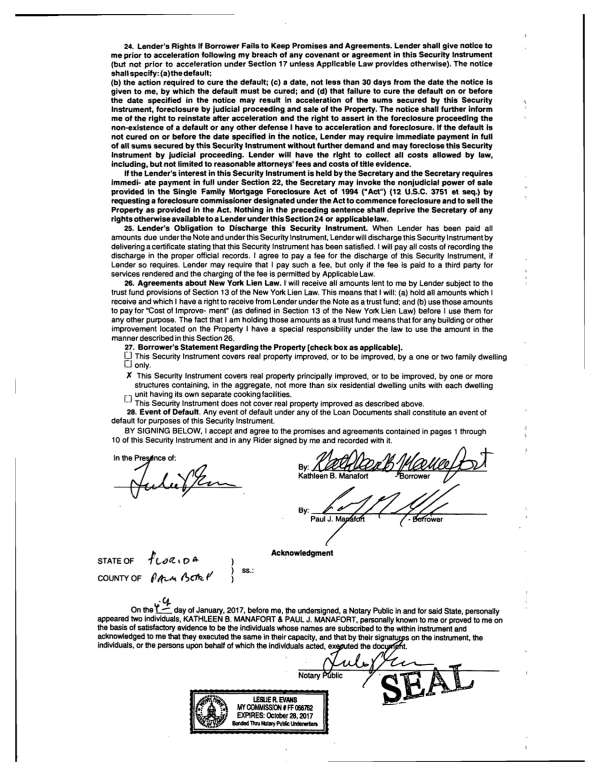

5. The most recent mortgage loan transactions occurred in January 2017. The loans were made by The Federal Savings Bank, a federally chartered bank based in Chicago. The Federal Savings Bank is a relatively small bank (total assets of $297 million (link)) that appears to specialize in mortgage loans for low to moderate income borrowers, focusing on VA loans and FHA loans for military and first time home buyers (link). Its founder, Chairman and Chief Executive Officer is Steve Calk, an early supporter of the Trump campaign and a named member of the Trump Economic Advisory Council. On January 17, 2017, The Federal Savings Bank made two mortgage loans to Manafort: one for $5.3 million (matching the total amount available under the Genesis Capital mortgage in default) and another for $1.2 million. These two loans totaling $6.5 million were in addition to a $9.5 million mortgage loan, also from The Federal Savings Bank, made just one month earlier in December 2016 to an LLC connected to Manafort and secured by a property in Bridgehampton. The $16 million total of these three loans made by The Federal Savings Bank appears to be a relatively large percentage of the bank’s total assets (5.4%) and total shareholder equity (23.7%). Reference to home values in the area suggests that the outstanding principal on the loan secured by the townhouse at 377 Union Street may exceed the market value of the property. Reports suggest that the property has been empty for the last 4 years and is currently in disrepair (link). The mortgage secured by the Bridgehampton property indicates that the borrower was required to deposit $630,000 as additional collateral. The mortgage secured by 377 Union Street indicates that the borrower was required to deposit $2.5 million as additional collateral.

Part II: Timeline and source documents

Credit to Pardon Me for Asking for uncovering Manafort’s connection to 377 Union Street and the mortgage loans on that property.

Credit to reader James Proctor for creating a graphic timeline based on the transactions and events described in Part II.

April 26, 2012: First Republic Bank provides a $1,500,000 mortgage loan to MC Soho Holdings, LLC, a limited liability company connected to Manafort. The loan is secured by a condo at 27 Howard Street and its term ends on May 1, 2042. (link)

April 7, 2015: UBS Bank USA provides a $3,000,000 mortgage loan to Manafort. The loan is secured by a condo in Trump Tower and its term ends on May 1, 2040. (link)

March 4, 2016: Citizens Bank N.A. extends an additional $1,230,000 loan on the 27 Howard Street property. After this transaction, a total of $2,730,000 is available for borrowing on the 27 Howard Street property. The term ends on April 1, 2046. (link)

March 4, 2016: Genesis Capital, a “private money lender for professional investors” (link), provides (i) a mortgage loan for $3,897,468, personally guaranteed by Yohai and Jess Manafort and (ii) a mortgage loan for $1,402,532, personally guaranteed by Manafort, to MC Brooklyn Holdings, LLC, a limited liability company connected to Manafort and Yohai. The loans are secured by the 377 Union Street property. The term ends on March 7, 2017 and the interest rate is 9.99%. (link; link)

March 29, 2016: Trump announces Manafort as Campaign Convention Manager. (link)

June 1, 2016: MC Brooklyn Holdings, LLC fails to make its scheduled monthly payment on the Genesis Capital loan. Genesis Capital files a complaint in state court in Brooklyn and attempts to initiate foreclosure proceedings on the 377 Union Street property. (image)

June 20, 2016: Manafort replaces Corey Lewandowski as Trump campaign manager. (link)

August 19, 2016: Manafort resigns from Trump campaign. (link)

November 17, 2016: Guy Aroch, a New York-based photographer (link), files a complaint in federal court accusing Yohai of “operating a Ponzi scheme” whereby Yohai meets public figures and celebrities through Manafort, lures them into the scheme with “claims of quick success — and repays his earlier investors with incoming funds.” (image)

December 16, 2016: The Federal Savings Bank loans $9.5 million to Summerbreeze LLC, an LLC connected to Manafort. The loan is secured by a property located at 174 Jobs Lane in Bridgehampton. The term ends on December 1, 2046. (image)

December 20, 2016: Four deeds of trust are filed in LA County securing prior loans from Manafort, his wife and daughter to LLCs connected to Manafort and Yohai. (image)

December 21, 2016: The same LLCs connected to Manafort and Yohai file for bankruptcy protection. (link)

January 4, 2017: MC Brooklyn Holdings, LLC transfers the 377 Union Street property to Manafort. (link)

January 17, 2017: The Federal Savings Bank provides to Manafort and his wife (i) a mortgage loan of $5.3 million (apparently to refinance the Genesis Capital loan) and (ii) a mortgage loan of $1.2 million. The loans are secured by the 377 Union Street property. The debt must be paid in full by January 4, 2018. (link; link)